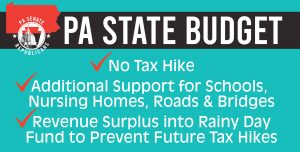

State Budget Holds the Line on Taxes, Boosts Rainy Day Fund, Supports Schools

The Senate approved a 2021-22 state budget that supports Pennsylvania’s economic recovery from the COVID-19 pandemic, while providing a financial safety net for the future.

The Senate approved a 2021-22 state budget that supports Pennsylvania’s economic recovery from the COVID-19 pandemic, while providing a financial safety net for the future.

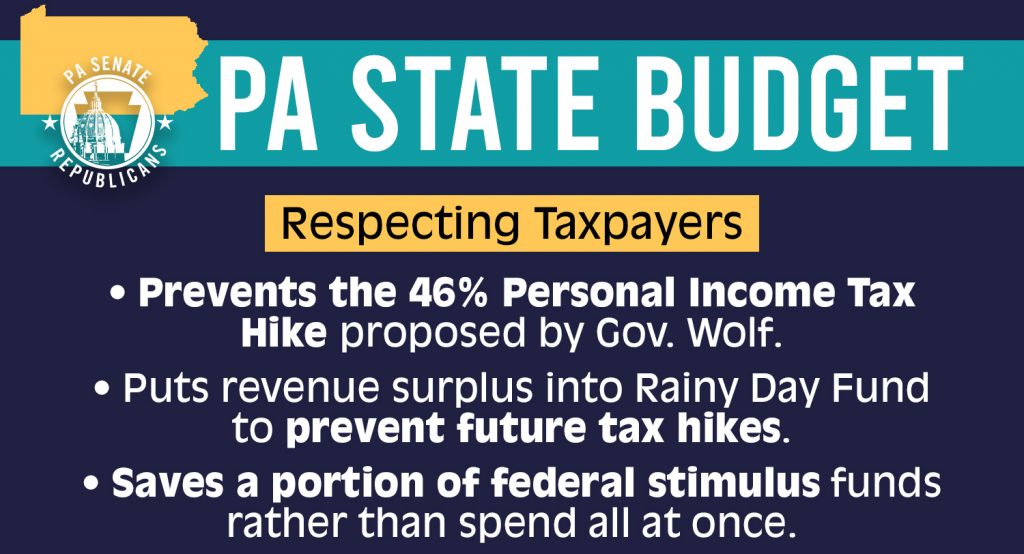

The fiscally responsible budget does not include any of the tax increases proposed by the governor in February — including a 46% Personal Income Tax hike.

While Pennsylvania is on pace to end the current fiscal year with $2.5 billion in surplus revenue, revenue projections for the current fiscal year were made as Pennsylvania was coping with the financial devastation caused by the global pandemic and the governor’s business closure orders.

Despite a significant rebound in revenues and the availability of federal stimulus funds to help balance the budget, lawmakers must remain vigilant and pragmatic because Pennsylvania’s mandated spending growth still outpaces its revenue growth and the Commonwealth cannot depend on continued federal funding.

The budget provides a three-tier approach to create a strong financial safety net for coming years:

- All $2.5 billion in surplus FY 2020-21 funds will be allocated to the Rainy Day Fund, augmenting the current $240 million balance in that account.

- $2.5 billion in projected surplus revenue from FY 2021-22 will be used to balance next year’s budget.

- $2.6 billion of remaining federal funding will also be used to help balance next year’s budget.

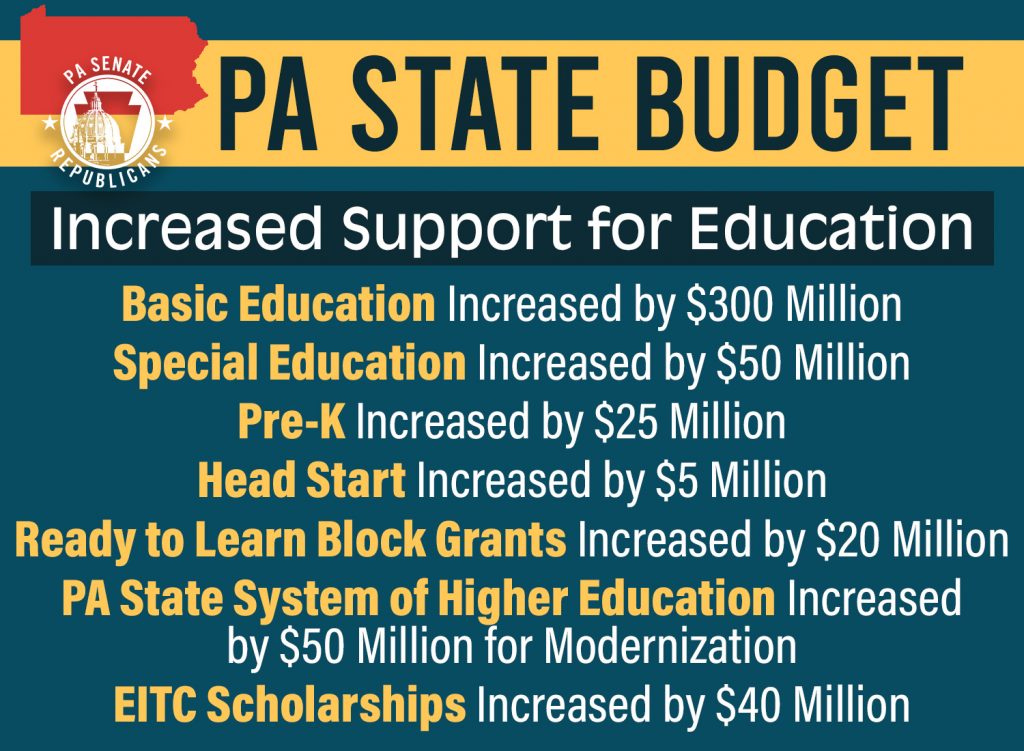

The spending plan includes $300 million more for Basic Education Funding, $50 million more for Special Education, $25 million more for Pre-K programs and $5 million more for Head Start.

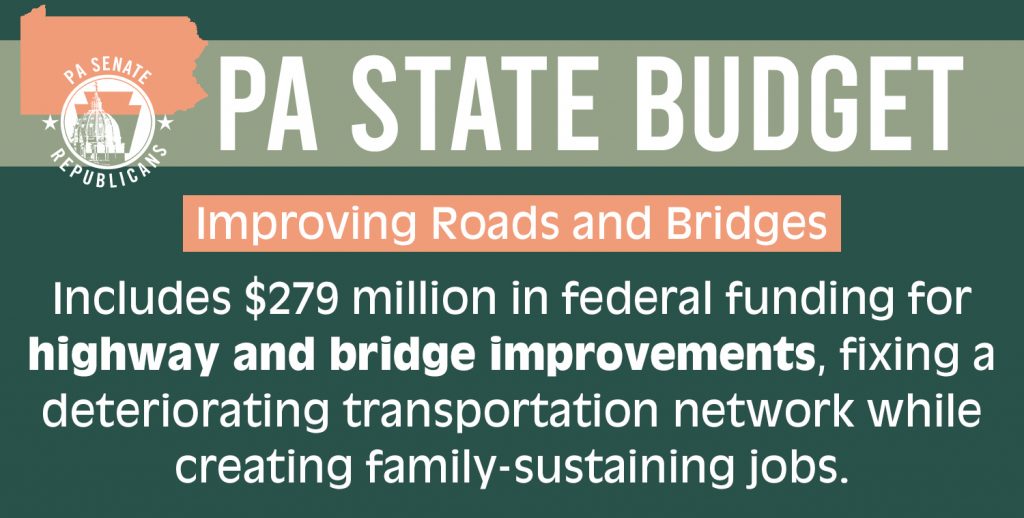

The budget allocates $279 million in federal funding to support highway and bridge improvement projects. This will enable the Commonwealth to address its deteriorating transportation network while supporting employers and creating family sustaining jobs.

A total of $282 million in federal money is directed to supporting Pennsylvania’s nursing homes ($247 million) and assisted care facilities and personal care homes ($30 million), many of which were severely impacted by the COVID-19 pandemic. In addition, $5 million will provide for ventilation improvements.

It’s critical that Pennsylvania transition from the crisis mode of the pandemic, to one of long-term planning and sustained job growth. This budget not only prevented the governor’s massive tax hikes, it also sets state money aside in the Rainy Day fund and spreads out federal relief funds to prevent future tax increases.

Summary of the Fiscal Year 2021-22 Budget

- Senate Bill 255 is the $40.8 billion General Fund Budget for Fiscal Year 2021-22.

- The budget promotes Pennsylvania’s economic recovery, while saving funds to provide a financial safety net for the future.

- The fiscally responsible budget rejects the governor’s tax increase proposals.

- Restores the governor’s proposed cuts for health care and agricultural programs and services.

Building a Solid Financial Reserve to Protect the Future

- While Pennsylvania is on pace to end the current fiscal year with $2.5 billion in surplus revenue, it is vitally important to remember that the revenue projections for Fiscal Year 2020-21 and the budgeted expenditures were made as Pennsylvania was coping with the financial devastation caused by the global pandemic.

- Fortunately, Pennsylvania’s economy is improving, but the anticipated surplus funds are not indicative of a booming economy, but rather are primarily the result of the infusion of federal stimulus funding combined with revenue collections that exceeded the intentionally low projections made last year.

- Pennsylvania’s employers and municipalities across the state will attest that our economic recovery is far from complete.

- We still anticipate state expenses to grow at a faster rate than revenues and we cannot depend on continued federal funding.

- Pennsylvania must avoid repeating the problems faced during the Corbett Administration. Reckless and excessive spending of federal stimulus funding would surely return us to the same dismal financial position that the Commonwealth faced in Fiscal Year 2011-12.

- This budget package provides a three-tier approach to bolster the state Rainy Day Fund to provide a strong financial safety net:

- All $2.5 billion in surplus FY 2020-21 funds will be allocated to the Fund, augmenting the current $240 million balance in that account.

- $2.5 billion in projected surplus revenue from FY 2021-22 to go to the Fund.

- $2.6 billion in federal funding to go to the Fund.

- In addition, the budget exercises good financial stewardship with the repayment of previous loans:

- $145 million from the Workers Compensation Security Fund to support Pennsylvania’s struggling hospitality industry as it copes with the devastation created by the COVID-19 pandemic and the Governor’s mandated closings and restrictions.

- $86 million from the Underground Storage Tank Indemnity Fund to help balance the Fiscal Year 2002-03 budget.

Budget Says “NO!” to Governor’s tax increases

- The governor proposed several tax increases in February, none are included in this year’s budget.

- The governor wanted to increase the state personal income tax (PIT) rate from 3.07 percent to 4.49% (a 46% increase) as of July 1. One-third of all Pennsylvanians and upwards of one million small businesses would have their tax rates increased by the governor’s proposal.

- The Legislature again rejected the governor’s annual push for a Marcellus Shale Extraction Tax.

- The governor wanted to “repurpose” money from the Horse Racing Development Fund ($199 million) to the Nellie Bly Tuition Program.

Spending

- The proposed $40.8 billion Fiscal Year 2021-22 General Fund Budget represents a $1 billion (2.6%) increase in state spending from the current fiscal year.

- Senate Republicans focused on developing a state spending plan and other legislation currently under consideration to provide essential assistance to families and employers — especially in the hospitality industry — impacted by the pandemic.

Education

- Senate Republicans recognize the importance of all Pennsylvania schools and the vital role they play in ensuring today’s students are given the tools to be competitive in the 21st Century global marketplace and be productive members of our communities. To that end, the budget includes the following funding increases in education programs:

- $300 million more for Basic Education.

- $50 million more for Special Education.

- $25 million more for Pre-K.

- $5 million more for Head Start.

- $20 million more for Ready to Learn Block Grants.

- $50 million more for PA State System of Higher Education

- $40 million more for Educational Improvement Tax Credit (EITC) Scholarships

Funding Transportation Improvements

Help for Nursing Homes

More

- The budget includes $372 million in “Pandemic Response” and $50 million to the Pennsylvania Housing Finance Agency for construction cost relief, to help builders of low-income housing cope with the increased costs of materials caused by the pandemic.

- The budget restores all of the Governor’s proposed cuts in state funding for agricultural programs and services. In addition, it includes a $3 million increase in the State Food Purchase line to $22.6 million.

- A $14 million increase in funding for intellectual disability services is expected to move more than 800 Pennsylvanians from the current waiting list.

- Changes to the Tax Reform Code will provide several exemptions from the state Sales and Use Tax:

- Computer data center equipment — $14 million.

- Helicopter flight simulators — $2.6 million.

- Breastfeeding equipment — $1.3 million.

- ATVs used for farming — $800,000.

- $30 million in new funding is allocated for violence intervention and prevention

Senate Republican Leaders Hail Passage of Fiscally Responsible State Budget

Senate President Pro Tempore Jake Corman (R-Bellefonte), Senate Majority Leader Kim Ward (R-Westmoreland) and Senate Appropriations Committee Chair Pat Browne (R-Allentown) addressed passage of a fiscally responsible state budget that boosts funding for schools, nursing homes and transportation.

The leaders issued the following statements in reaction to passage of the budget:

“The budget offers a blueprint to help our Commonwealth recover from the damage created by the COVID-19 pandemic and chart a better path forward. The past year and a half was extremely difficult for many Pennsylvania families and employers. In light of these difficult circumstances, I am thankful that we were able to pass a fiscally responsible budget that helps us tackle the immediate needs created by the pandemic as well as the financial challenges that lie ahead.” – Senator Corman

“Pennsylvania’s 2021-2022 budget demonstrates resilience by helping the Commonwealth transition out of crisis while positioning Pennsylvania for success. It is not a statement of a ‘new normal’ rather a declaration in rejecting restrictions and ‘retuning to life as normal.’ This $40.8 billion budget tackles the most immediate challenges facing our schools, nursing homes, infrastructure, and struggling families while saving funds to provide a financial net for the future. It makes historic investments in school choice and provides aid to families struggling to move past the COVID-19 pandemic by offering rental, utility and water assistance, as well as child childcare stabilization. This budget takes the necessary steps to put our Commonwealth on an forward trajectory that is foundational in setting our future path forward by providing us with the flexibility we need to get Pennsylvanians back to work and our economy growing again.” – Senator Ward

“This budget takes into consideration lessons we learned from the Great Recession by ensuring we are responsible, not only with how we use federal stimulus money, but also with the decisions we are making here today to put us on as solid fiscal ground as possible heading into those years when the stimulus money runs out and the threat of a fiscal cliff is real. With that in mind, however, this budget still provides essential funding increases to help our students, as well as necessary long-term and critical care assistance for our older population and our citizens with disabilities.” – Senator Browne